Finance & Accounting

100 articles

The Hidden Drain: 5 Ways Nigerian SMEs Lose Cash Without Noticing

Most Nigerian SMEs do not fail because sales are low. They fail because cash quietly leaks out every day. These …

The Rise of the Zero-Employee Finance Department

Hiring a full finance team used to be a requirement for growth. Today, it is becoming a liability. Founders are …

The Joint Revenue Board: How Your NIN, BVN, and Tax ID Are Now Linked

A founder recently shared a story that sounds familiar. His bank account was active. His BVN was valid. His NIN …

The “Agency” Dilemma: Managing Project-Based Finances vs. Recurring Revenue

For agencies, money often arrives unpredictably. Some months, multiple projects land at once, and cash flows in like a river. …

Hiring Your First Accountant: What to Look for (And What AI Can Do Instead)

Hiring your first accountant feels like a milestone. It’s exciting, but also nerve-wracking. Questions flood your mind: Do I need …

Financial Anxiety: How Automated Books Cure “Sunday Night Panic”

Financial anxiety often shows up right on schedule. It creeps in on Sunday night, just as the week approaches. You …

Business vs. Pleasure: The Danger of Commingling Funds

Commingling funds is one of the most common mistakes founders make, often without realizing it. It usually starts innocently. You …

Founder Salary: How to Pay Yourself Legally (and Tax-Efficiently)

Founder salary is one of the most uncomfortable topics in early-stage businesses. Many founders delay paying themselves out of guilt, …

Valuation 101: How Clean Books Increase Your Company’s Worth

Valuation is rarely driven by revenue alone. Many founders assume strong growth will automatically translate into a higher company price. …

Scenario Planning: “What If Sales Drop 20%?” Modeling Best & Worst Cases

Scenario planning starts with uncomfortable questions. What if sales suddenly drop by 20%? What if customers delay payments? What if …

The Co-Founder Equity Split: Handling Finances When Partners Separate

Co-founder equity split conversations rarely happen calmly. What starts as a shared dream can slowly turn into tension, silence, and …

Profit Margins: Identifying Which Product Line Is Actually Making Money

Profit margins tell a very different story from revenue. Many founders celebrate strong sales numbers while quietly losing money underneath. …

Grant Opportunities: Preparing Your Financials for Federal & State Grants

Grant opportunities sound like free money until the application process begins. Many founders get excited when they see federal or …

Burn Rate Control: How to Scale Fast Without Running Out of Cash

Burn rate control is the difference between startups that scale confidently and those that shut down unexpectedly. Many founders assume …

Unit Economics: Calculating Your Customer Acquisition Cost (CAC) in Naira

Unit economics explain why some startups grow confidently while others run out of money despite rising revenue. Growth feels exciting …

Predictive Finance: Using AI to See Your Bank Balance 3 Months from Now

Most people only realize there is a money problem when their balance drops. Bills hit, payments are delayed, and suddenly …

Excel Is Not Enough: Why Spreadsheets Can’t Handle 2025 Complexity

In 2025, Excel is not enough to manage real-time finance, forecasting, and decision-making. Excel built modern business finance. Excel is …

How Much Cash Runway Does a Nigerian SME Actually Need?

Most small businesses do not fail because of bad ideas. They fail because something unexpected happens fuel prices rise, a …

Simple Ways Small Businesses Can Protect Against Currency Devaluation

One morning, your costs are manageable. A few weeks later, the exchange rate moves and suddenly everything is more expensive. …

Fuel Subsidy Removal: Re-calculating Your Operating Costs for 2025

Fuel used to be a background cost. Now it is a line item that affects almost everything. Since fuel subsidy …

Vendor Negotiations: How to Demand Better Payment Terms in a Tight Economy

In a tight economy, sales slow down, costs rise, and cash feels harder to hold onto. For many businesses, the …

Expense Cutting 2.0: Identifying “Zombie Subscriptions” Eating Your Reserves

You cut staff costs. You reduced marketing spend. You negotiated rent. Yet cash still feels tight. For many businesses, the …

The “Detty December” Survival Guide: Managing Liquidity During the Holidays

December is here. The parties, bonuses, gifts, and travel plans all add up. For many business owners, “Detty December” brings …

Cash Flow vs Profit: Why You Can Be “Profitable” but Still Broke

The numbers looked good. Revenue was growing. The profit line was positive. The business owner felt confident, until rent was …

Pricing Power: How to Raise Prices in Inflation Without Losing Customers

Inflation does not announce itself politely. One month your costs are stable. The next month, suppliers adjust prices “due to …

What to Do When Clients Pay Late: Cash Flow Strategies for SMEs and Freelancers

It starts small. One invoice is a few days late. Then another. Suddenly, your bank balance looks tighter than expected. …

How to Identify Profit Leaks in Your Business

Profit leaks are like slow drips in a bucket, you might not notice them at first, but over time, they …

How to Track Expenses When Running Multiple Businesses or Side Hustles

Running more than one business or side hustle can be exciting—but it can also be confusing, especially when it comes …

How to Read Basic Financial Reports Even if You Are Not an Accountant

Financial reports can feel like a foreign language. Numbers, jargon, tables, and charts can intimidate even experienced business owners. But …

How to Manage Cash Sales, Cash Expenses, and Keep Clean Records

Cash can feel simple. No payment processors, no delays, no fees. But cash is also where many businesses quietly lose …

How to Price Products and Services for Profit (Without Guessing)

Pricing is one of the fastest ways to kill a business, or make it wildly profitable. Many founders underprice because …

Budgeting for Startups: How to Plan Monthly Costs When Business Is Unpredictable

Budgeting for startups sounds simple until real life hits. One month you land a big client. The next month payments …

How to Use Simple Spreadsheets or Zaccheus to Track Business Income and Expenses

When Aisha started her baking business in Lagos, she wrote down sales in a notebook and trusted her memory for …

Starter’s Guide to Profit and Loss for New Entrepreneurs in Nigeria

When Tope started his small logistics business in Ibadan, customers were paying, expenses were going out, and everything looked fine. …

Business vs Personal Money: Why Every Entrepreneur Should Separate Their Accounts

When Tunde launched his small skincare brand from his living room, he used one bank account for everything like transport, …

How to Keep Track of Every Naira as a Nigerian SME

Most Nigerian SMEs lose money without noticing it. Small leaks eventually become big financial problems. The good news is that …

The Role of Technology in Financial Inclusion for Nigerian Entrepreneurs

Financial inclusion is a cornerstone of economic growth, yet many Nigerian entrepreneurs have historically faced barriers to accessing banking, loans, …

What Every Entrepreneur Should Know About Business Valuation

Understanding business valuation is crucial for every entrepreneur. Whether you are raising funds, selling your business, or attracting investors, knowing …

How to Integrate Fintech Tools Into Your Business Accounting System

In today’s fast-paced business environment, integrating fintech tools into your accounting system is no longer optional, it’s essential. These tools …

How Digital Banking Is Helping SMEs Thrive in Africa

Digital banking for SMEs in Africa is transforming how small businesses operate. Traditionally, limited access to banking, slow payments, and …

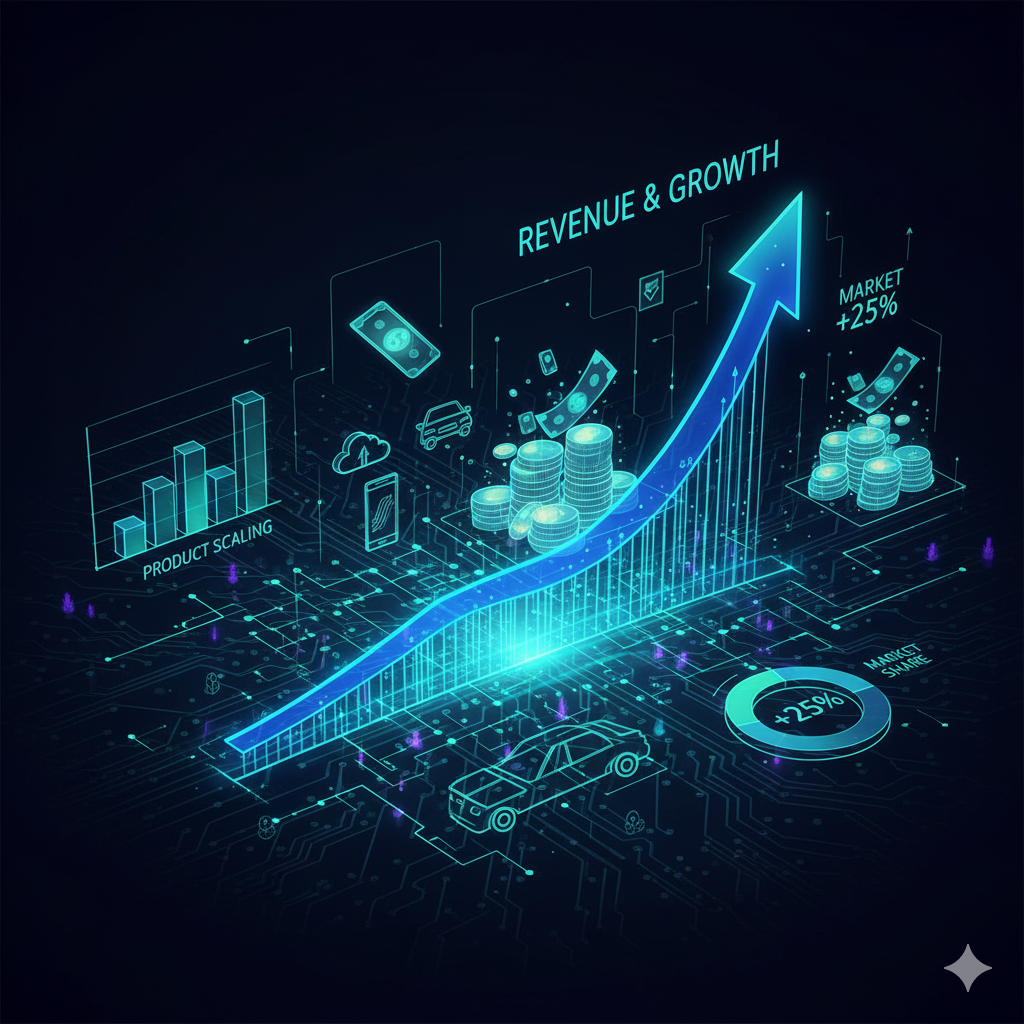

Understanding the Link Between Accounting and Business Growth

Understanding the link between accounting and business growth is essential for any entrepreneur or business owner. Strong financial management goes …

How to Create a Financial Model That Attracts Venture Capital: Essential Playbook

Many founders lose investor interest because their financial model looks confusing or unrealistic. Venture capitalists do not just fund great …

How Nigerian Businesses Can Access Foreign Grants: The Ultimate Guide

Many Nigerian founders struggle with one challenge, the lack of adequate funding. Foreign grants feel out of reach for most …

The Importance of Financial Transparency in Startup Growth

For startups, growth isn’t just about gaining customers or increasing revenue, it’s also about building trust. One of the most …

The Role of ESG in Attracting Investors

Funding has become more competitive, and investors want more than financial projections. They want proof that a company operates responsibly …

How to Build a Business Budget for a Product Launch

Launching a new product is exciting, but without a clear financial plan, it can quickly become costly and chaotic. Many …

The Pros and Cons of Outsourcing Your Accounting Functions

Managing the finances of a business can be complicated, especially for small and medium-sized enterprises. From payroll to taxes and …

How to Handle Fraud and Financial Mismanagement in Small Businesses

Small businesses are particularly vulnerable to fraud and financial mismanagement. Limited oversight, stretched resources, and informal processes can make it …

Sustainable Financing in Nigeria: How Businesses Can Benefit

Running a business in Nigeria comes with challenges from fluctuating costs to access to capital, and unpredictable markets. But there’s …

How to Stay Profitable During an Economic Downturn

Economic downturns are tough. Sales slow, costs rise, and uncertainty looms. Many businesses struggle to survive, while others not only …

Understanding the Impact of Inflation on Business Valuation

Imagine waking up tomorrow and realizing that every dollar your business earns is worth less than it was yesterday. Prices …

How to Track and Improve Your Business Profit Margins

Every business owner loves the idea of making more money, but real success is not measured by how much you …

How to Prepare Financially Before Expanding to New Markets

Expanding your business into a new market is exciting, but it can also be risky. Imagine pouring resources into growth, …

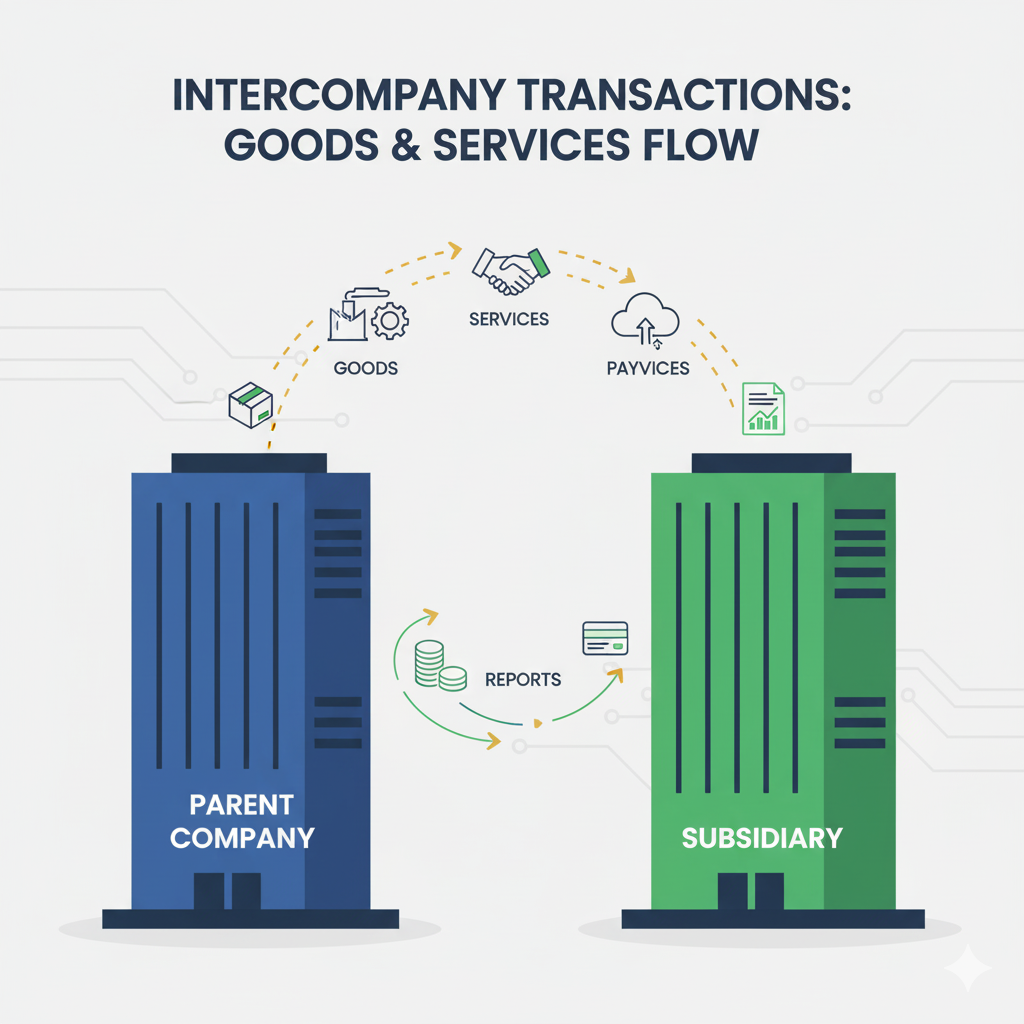

What Every Nigerian Business Should Know About Transfer Pricing

Transfer pricing is not just a technical accounting concept reserved for global conglomerates for Nigerian businesses that deal with related …

How to Handle Financial Disputes Between Co-Founders

Financial disagreements can destroy even the strongest partnerships. Many startups fail because co-founders avoid difficult money conversations until it is …

How to Create a Solid Exit Strategy for Your Business

Many business owners build and grow their companies without thinking about how they will eventually leave. This creates stress, financial …

Understanding Financial Statements for Non-Finance Founders

Every founder needs to understand financial statements, even if they do not have a finance background. Your financial reports reveal …

How to Manage Investor Funds Responsibly as a Startup Founder

Raising capital is one thing. Managing that money responsibly is a different skill entirely. Many founders underestimate how quickly investor …

The Future of Work and Remote Finance Teams in Nigeria

The future of work in Nigeria is changing faster than most founders expected. Remote teams have become part of everyday …

The Psychology of Money: How Founders Make Better Spending Decisions

Money isn’t just numbers on a spreadsheet, it’s habits, emotions, and mindset. For startup founders and SME owners, managing limited …

How to Maintain a Positive Cash Flow During Slow Seasons (Smart Strategies for SMEs)

Every business, regardless of industry or size, experiences periods where revenue slows down. These slow seasons can be challenging, especially …

How to Secure Angel Investors for Your Startup in Nigeria

Securing angel investors in Nigeria often feels difficult, especially for early-stage founders who need funding to grow. Many entrepreneurs struggle …

What Nigerian SMEs Can Learn From Global Accounting Practices

Global accounting practices continue to shape how successful businesses operate across the world, and Nigerian SMEs can learn a lot …

The Hidden Costs of Running a Business in Nigeria: What Entrepreneurs Overlook

Starting a business in Nigeria sounds exciting, until reality sets in. Beyond rent, salaries, and basic expenses, there are countless …

Equity vs Loan for Business: How to Choose the Best Funding Option for Your Growth

Every entrepreneur eventually faces a major financial decision:Should I raise equity or should I take a loan? This question is …

Understanding the 2025 Finance Act: What Entrepreneurs Need to Know

If you run a business in Nigeria, you probably already know that every January comes with a new wave of …

How to Build a Scalable Pricing Model for Your Products or Services

Setting the right price for your products or services can make or break your business. Too high, and you risk …

Manage Business Debts Without Killing Growth: How Founders Can Stay Profitable

Managing business debts feels overwhelming for founders and small business owners because every repayment affects cash flow. You want to …

The Truth About Financial Projections and Investor Confidence: How to Gain Investor Trust

Imagine pitching your business to an investor. You’ve rehearsed your speech, prepared your slides, and feel confident. Then comes the …

Multi-State Payroll Made Simple: How to Stay Compliant and Stress-Free

If you have employees scattered across the country, payroll can go from simple to stressful fast.Multi-state payroll brings unique challenges, …

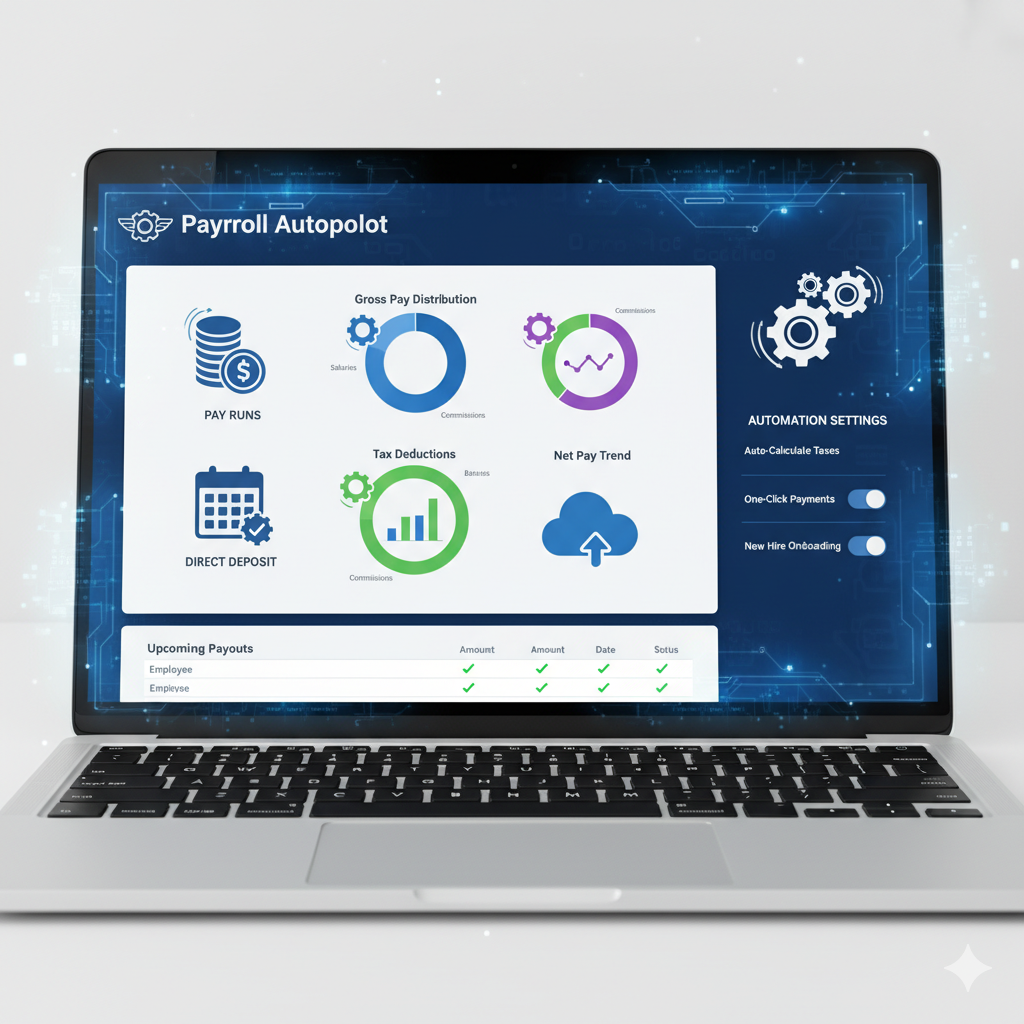

Payroll Processing Software for Accountants | Simplify & Automate with Zaccheus

If you’re an accountant, you already know this truth: payroll can be a nightmare. Endless spreadsheets. Manual tax updates. Frantic …

Mastering Payroll Run in Nigeria: A Simple Guide for Stress-Free Salary Management

Picture this: It’s month-end in Lagos. Your employees are waiting for their salaries, your accountant is buried in spreadsheets, and …

Global HR and Payroll: A Complete Guide for Startups and SMEs Expanding Internationally

Global HR and payroll management has become a game-changer for Nigerian startups expanding across borders. Imagine your Lagos fintech is …

Payroll Management System: The Smarter Way to Pay Your Team

Imagine never worrying about PAYE deadlines, PENCOM penalties, or “Madam, my salary is short” WhatsApp messages again. A payroll management …

Automated Payroll Processing: Ditch the Spreadsheets and Reclaim Your Fridays

Let’s be honest, no founder ever started a business dreaming about payroll Fridays. Manually calculating hours, double-checking taxes, and praying …

Cost-Cutting Strategies for Startups During Economic Inflation

Inflation puts real pressure on startups. Costs rise, margins shrink and cash-flow can get squeezed before you know it. But …

How Fintech Apps Are Changing Business Banking in Nigeria

Business banking in Nigeria is undergoing a massive transformation. For years, startups and SMEs struggled with slow bank processes, rigid …

Cash Flow Statements Made Simple: A Founder’s Guide to Financial Clarity

As a founder, you probably track revenue, expenses, and growth metrics but the real risk for startups isn’t profitability on …

Simple and Powerful Ways to Automate Your Business Finances in 2025

Managing your business finances manually in 2025 is like using a typewriter in the smartphone era. It’s time-consuming, error-prone, and …

How the CBN’s New Monetary Policies Affect Small Businesses

If you’re running a small business in Nigeria you’re likely feeling the squeeze. With the Central Bank of Nigeria (CBN) …

Depreciation and Fixed Assets Explained

Ever wondered why your accountant keeps talking about “depreciation” or “fixed assets” and how they affect your profit? Here’s the …

End-of-Year Checklist for Nigerian SMEs to Stay Ahead in 2026

The end of the year is more than just holiday sales and staff parties, it’s the perfect time to assess …

Financial Health Check: Proven Ways to Keep Your Business Thriving

Running a business without checking its financial health is like driving blindfolded. You might be moving fast, but you have …

Data-Driven Decisions: Proven Ways to Drive Business Growth

In today’s fast-changing economy, gut feeling alone no longer guarantees success. Nigerian entrepreneurs now face tighter margins, unpredictable markets, and …

Why Financial Literacy Should Be a Priority for Entrepreneurs

Starting and running a business feels exciting, but one mistake can sink the dream: not understanding the numbers. That’s where …

Economic Uncertainty: Smart Ways to Protect Your Business

Economic uncertainty can feel like a dark cloud over your business. You might worry about rising costs, shifting customer demand, …

How Exchange Rate Fluctuations Affect Your Business Profit

Have you ever noticed how the price of a product changes when you buy it in another currency? One day …

Modern Accounting: How Technology Is Transforming Finance

Accounting used to mean stacks of paper, confusing spreadsheets, and long nights balancing numbers. Today, things are very different. Thanks …

5 Audit Triggers Nigerian SMEs Must Avoid

Every Nigerian business dreads the words “FIRS audit.” Whether you run a startup in Lagos or an SME in Abuja, …

Create a Financial Plan That Wins Investors

Getting investors interested in your startup takes more than a brilliant idea, it takes proof that your business can grow …

Smart Strategies to Stop Employee Expense Fraud Fast

Employee expense fraud can quietly drain your business’s finances and erode workplace trust. It happens when employees falsify or exaggerate …

Budget vs Forecast: What’s the Difference and Why It Matters for Your Small Business

Running a small business is like planning a road trip, you need a map. Financial terms like “budget” and “forecast” …

How to Build a Simple Invoice System That Saves You Hours and Boosts Your Cash Flow

Invoicing doesn’t have to be a time-sucking chore. As a small business owner or freelancer, you’ve got enough on your …

Common Bookkeeping Mistakes Non-Accountants should Avoid

Running a small business is exciting, but let’s be real: keeping track of finances can feel like wrestling a bear. …

Financial Red Flags Investors Notice Instantly

You only get one chance to impress an investor and your financials speak louder than your pitch deck. No matter …

Separating Personal and Business Finances: The Critical Step for Success

If you run a business or freelance gig, you’ve probably been tempted to “just use your personal card this one …

SME Grants and Funding Opportunities in Nigeria (2025 Update)

If you’re running a small or medium-sized enterprise in Nigeria, here’s some good news: 2025 is shaping up to be …

Smart Record-Keeping Habits That Make Audits Easy and Stress-Free

Let’s be honest, the word audit makes most business owners nervous. But here’s the truth: these reviews only become stressful …

How to Build a Financial Dashboard That Works

It’s one thing to collect financial data. It’s another to turn that data into insights your team can act on. …

Hire an Accountant for Your Small Business: 5 Costly Mistakes to Avoid

Running a small business is exciting but let’s be honest, it can also be stressful when it comes to money. …