Excel Is Not Enough: Why Spreadsheets Can’t Handle 2025 Complexity

In 2025, Excel is not enough to manage real-time finance, forecasting, and decision-making. Excel built modern business finance. Excel is …

In 2025, Excel is not enough to manage real-time finance, forecasting, and decision-making.

Excel built modern business finance.

Excel is also quietly breaking it.

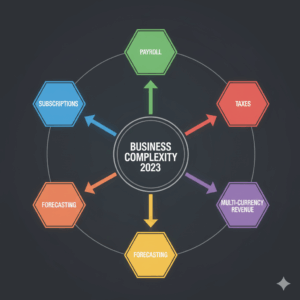

In 2025, founders, freelancers, and SMEs face financial complexity that spreadsheets were never designed to handle. Subscriptions, global payments, taxes, payroll, forecasting, and investor reporting all collide inside fragile files that depend on manual updates and perfect formulas.

This article explains why Excel is not enough anymore, where spreadsheets fail first, and what smarter financial systems look like in 2025.

Why Excel Became the Default for Finance

Spreadsheets earned their place.

Excel is flexible, familiar, and powerful for calculations. For decades, it helped businesses track expenses, build budgets, and prepare reports without specialized software.

Early-stage companies especially relied on Excel because:

- It was cheap or free

- Everyone knew how to use it

- It worked well for simple financial tracking

The problem is not that Excel is bad.

The problem is that business finance outgrew it.

Why Excel Is Not Enough for 2025 Business Complexity

Modern businesses operate in ways that did not exist when spreadsheets became popular.

Suggested read: The “Agency” Dilemma: Managing Project-Based Finances vs. Recurring Revenue

Recurring Revenue Models

Subscriptions, retainers, usage-based billing, and churn tracking require constant updates. Excel cannot sync this data automatically.

Real-Time Decision Pressure

Founders need instant answers:

- Can we afford this hire?

- What happens if revenue dips 10 percent?

- How long is our runway?

Spreadsheets answer yesterday’s questions, not today’s.

Tool Sprawl

Businesses now use payment processors, banks, accounting tools, payroll systems, and analytics platforms. Excel does not integrate cleanly with most of them.

Compliance and Reporting

Taxes, payroll laws, and financial reporting standards have grown more complex. Manual tracking increases risk.

This is why Excel is not enough in 2025.

Where Spreadsheets Break Down

1. Manual Data Entry

Every spreadsheet depends on humans copying and pasting data. This creates delays and errors that compound over time.

One missed update can invalidate an entire financial model.

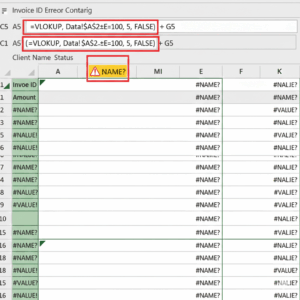

2. Formula Fragility

Spreadsheets fail silently.

A single broken formula can distort:

- Cash flow forecasts

- Profit margins

- Tax estimates

These errors often go unnoticed until money is lost.

Suggested read: Business vs. Pleasure: The Danger of Commingling Funds

3. Version Control Chaos

Multiple versions create confusion:

- “Final.xlsx”

- “Final_v2.xlsx”

- “Final_REAL.xlsx”

There is no clear source of truth.

4. No Real-Time Visibility

Spreadsheets are snapshots.

Business finance needs live data.

By the time numbers are updated, the decision window may already be gone.

The Hidden Cost of Spreadsheet Errors

Spreadsheet errors are not rare.

A study by the European Spreadsheet Risks Interest Group found that over 88 percent of spreadsheets contain errors. In finance, small mistakes become expensive ones.

Hidden costs include:

- Overhiring based on false forecasts

- Missed tax obligations

- Cash flow surprises

- Investor mistrust

Excel does not warn you when logic fails. It assumes perfection.

Excel vs Modern Financial Tools

| Feature | Excel | Modern Financial Platforms |

|---|---|---|

| Real-time data | ❌ | ✅ |

| Automation | ❌ | ✅ |

| Scenario planning | Manual | Instant |

| Error detection | ❌ | ✅ |

| Collaboration | Limited | Built-in |

| Scalability | Poor | Strong |

Spreadsheets are static.

Modern finance requires systems.

What Replaces Excel in 2025

Excel is being replaced by financial operating systems, not single tools.

Suggested read: Valuation 101: How Clean Books Increase Your Company’s Worth

These platforms:

- Sync directly with banks and payment providers

- Automate categorization and reporting

- Forecast cash flow in real time

- Run scenarios instantly

- Reduce human error

Instead of building fragile models, founders get clarity.

This is where tools like Zaccheus enter the picture.

How Smart Founders Manage Finance Today

High-performing founders treat finance as a live system, not a document.

They rely on:

- Automated data flows

- AI-driven forecasting

- Scenario modeling

- Clear dashboards instead of spreadsheets

An AI CFO approach replaces hundreds of spreadsheet hours with answers in seconds.

Zaccheus gives founders:

- Real-time financial visibility

- Forecasts they can trust

- Decision support without spreadsheet chaos

Conclusion: Excel Is Not Enough Anymore

Excel is not broken.

It is simply outdated for modern business finance.

In 2025, spreadsheets cannot handle:

- Real-time complexity

- Automation needs

- Scaling financial decisions

Businesses that move beyond Excel gain speed, accuracy, and confidence.

Suggested read: Scenario Planning: “What If Sales Drop 20%?” Modeling Best & Worst Cases

If your financial decisions matter, spreadsheets should not be your system of record.

Call to Action

If Excel is slowing you down, it is time to upgrade your financial stack.

Zaccheus acts as your AI CFO, replacing fragile spreadsheets with real-time insights, forecasting, and clarity built for modern businesses.

Explore Zaccheus at usezaccheus.com

FAQ

Why is Excel not enough for business finance in 2025?

Excel depends on manual updates and static data. Modern businesses need automation, real-time visibility, and forecasting, which spreadsheets cannot reliably provide.

Can small businesses still use Excel?

Yes, but only at the very beginning. As soon as revenue, expenses, or decision complexity increases, spreadsheets become risky and inefficient.

What is the biggest risk of spreadsheets?

Silent errors. A broken formula can mislead decisions without any warning, often costing money before the issue is discovered.

What should replace Excel?

A modern financial platform that syncs data automatically, forecasts in real time, and reduces human error.