How to Keep Track of Every Naira as a Nigerian SME

Most Nigerian SMEs lose money without noticing it. Small leaks eventually become big financial problems. The good news is that …

Most Nigerian SMEs lose money without noticing it. Small leaks eventually become big financial problems. The good news is that you can take full control of your money with a few reliable systems. This guide explains how to keep track of every naira as a Nigerian SME, improve cash flow visibility, and build a healthier business.

Let’s explore practical steps you can start today.

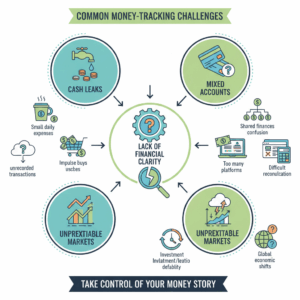

Why Nigerian SMEs Struggle to Track Money

Many Nigerian SMEs struggle with proper financial management. This usually happens for a few reasons.

1. Cash-Based Operations

Cash transactions move fast, and many are unrecorded. This leads to invisible leaks that eat into profit.

2. No Standard Expense Tracking System

When businesses rely on memory instead of organized records, details get lost. This makes financial analysis almost impossible.

3. Mixing Business and Personal Money

Owners often use one bank account for both personal and business expenses. This confusion makes it hard to know what the business truly earns.

4. Lack of Real-Time Visibility

SMEs that review their finances monthly instead of daily often discover problems long after they happen.

5. Unpredictable Market Conditions

Inflation, unstable FX rates, and supply chain changes affect Nigerian SMEs. Without tracking, these pressures hit harder.

How to Set Up a Solid Money Tracking System

A reliable system helps you know where every naira goes.

1. Separate Your Business and Personal Accounts

This simplifies accounting and gives you a clear financial picture. Your business performance becomes easier to understand.

Suggested read: Starter’s Guide to Profit and Loss for New Entrepreneurs in Nigeria

2. Create Clear Categories for Income and Expenses

Examples of categories include:

-

Sales revenue

-

Inventory purchases

-

Marketing expenses

-

Staff salaries

-

Utilities

-

Transport

-

Miscellaneous costs

Categorizing transactions helps you identify unnecessary spending.

3. Use a Central Dashboard for All Money Activities

A central dashboard helps you see everything at once. You know how much is coming in, going out, and remaining.

Suggested read: Profit Margins: Identifying Which Product Line Is Actually Making Money

4. Set Up Simple Money Policies

For example:

-

All expenses above a set amount must be recorded immediately.

-

Only one person handles payments.

-

Receipts must be stored digitally.

These rules reduce errors and confusion.

5. Track Cash Flow Weekly

Your cash flow should show:

-

Opening balance

-

Money received

-

Money spent

-

Closing balance

A weekly cash flow review helps you understand patterns.

Suggested read: Valuation 101: How Clean Books Increase Your Company’s Worth

Daily Financial Habits That Help You Track Every Naira

Daily habits create discipline and remove guesswork.

1. Record Every Transaction the Same Day

Do not postpone it. Record income and expenses immediately. This prevents forgotten details.

2. Review Your Account Balance Daily

Daily checks help you detect unusual deductions or unauthorized spending.

3. Keep Digital Copies of Receipts

This prevents fraud, supports audits, and makes reporting easier.

4. Track Inventory Daily or Weekly

For businesses that sell goods, inventory affects profit. Always match inventory changes with sales records.

5. Use Simple Forecasting

A basic forecast helps you predict:

-

How much money you will have

-

When cash might become tight

-

When to reinvest

This helps you make smarter decisions.

Suggested read: How to Price Products and Services for Profit (Without Guessing)

Tools That Make Money Tracking Easier for SMEs

Technology simplifies money tracking. Here are useful categories.

1. Accounting Apps

Tools like QuickBooks, Xero, or Wave help with bookkeeping and reporting.

2. Expense Tracking Apps

Apps that scan receipts or categorize expenses automatically save time.

3. Digital Banking Platforms

Banks with smart dashboards help you track spending categories.

4. AI Finance Tools

AI tools like Zaccheus provide real-time tracking, automatic reporting, and forecasting.

5. Spreadsheet Templates

For early-stage SMEs, well-structured Google Sheets or Excel templates can work until they scale.

How Zaccheus Helps Nigerian SMEs Track Every Naira Automatically

Zaccheus is designed for SMEs, freelancers, and startups. It helps monitor cash flow without manual stress. Here is how it supports money tracking.

1. Automated Expense Tracking

Zaccheus connects to your bank accounts and identifies spending patterns automatically.

2. Daily Cash Flow Monitoring

You get updates on how much money enters and leaves your business daily. This helps you manage working capital with confidence.

Suggested read: Business vs Personal Money: Why Every Entrepreneur Should Separate Their Accounts

3. Smart Budgeting

The system suggests realistic budgets based on your spending behavior.

4. Financial Alerts

Zaccheus notifies you when you overspend or fall below your financial safe zone.

5. Accurate Forecasting

The AI predicts future cash flow so you can plan ahead and avoid financial surprises.

If you want a simple way to keep track of every naira in your business, Zaccheus provides an AI-powered CFO that does the heavy lifting for you.

Common Mistakes SMEs Make With Money Tracking

Avoid these errors because they lead to lost revenue and confusion.

1. Relying on Memory Instead of Records

Even a small business should never depend on memory. It is unreliable.

2. Ignoring Small Expenses

Small expenses add up over time. Always record them.

3. Not Reconciling Bank Statements

Reconciliation helps you detect errors and unauthorized transactions.

4. No Backup of Financial Records

Digital backups protect your business from data loss.

5. Not Reviewing Financial Reports

Reports show trends and risks. Review them monthly and quarterly.

Suggested read: How to Create a Financial Model That Attracts Venture Capital: Essential Playbook

Conclusion

Learning how to keep track of every naira as a Nigerian SME gives you a powerful advantage. It helps you reduce waste, avoid financial surprises, and grow your business with confidence. With tools like Zaccheus, you can automate most of the work and get real-time visibility into your money.

Ready to track every naira without stress? Zaccheus helps you understand your cash flow, stay organized, and make smarter financial decisions.

Call to Action

Start managing your finances like a pro.

Visit usezaccheus.com to try the AI CFO built for Nigerian SMEs.

FAQs

1. What is the best way to track money as a Nigerian SME?

The best way to track money is to separate business accounts, record all transactions daily, categorize spending, and use digital tools that provide real-time visibility. Automated finance tools give you more accuracy and save time.

2. How can I prevent financial leaks in my business?

Record expenses immediately, review your cash flow weekly, reconcile your bank account, and monitor inventory. Financial leaks happen when transactions are unrecorded or when spending goes unmonitored.

3. Should SMEs use accounting software?

Yes, even small businesses benefit from accounting software. It reduces errors, organizes data, improves reporting, and helps you understand your financial health faster.

4. How can Zaccheus help my SME?

Zaccheus tracks expenses, monitors cash flow, sends alerts, and provides forecasts. This support helps SMEs make informed financial decisions without needing an in-house accountant or CFO.

5. How often should I review my finances?

You should check your account balance daily, review your cash flow weekly, and analyze financial reports monthly. This routine keeps your business financially healthy.