Starter’s Guide to Profit and Loss for New Entrepreneurs in Nigeria

When Tope started his small logistics business in Ibadan, customers were paying, expenses were going out, and everything looked fine. …

When Tope started his small logistics business in Ibadan, customers were paying, expenses were going out, and everything looked fine. Three months later, he could not explain where the money went. Sales were happening, but profit was missing.

This is a common story for new business owners. Many entrepreneurs in Nigeria confuse cash flow with profit. That confusion is exactly why understanding profit and loss for new entrepreneurs in Nigeria is not optional. It is survival.

In this guide, you will learn what profit and loss really means, how to calculate it, common mistakes Nigerian entrepreneurs make, and how to use it to grow a sustainable business.

What Is Profit and Loss?

Profit and loss, often called a P&L statement, is a financial report that shows whether your business is making money or losing money over a specific period.

It answers three simple questions:

-

How much money did you make?

-

How much did you spend?

-

What is left after expenses?

For new entrepreneurs in Nigeria, profit and loss is the clearest mirror of business reality. Bank balance alone can lie. P&L does not.

Suggested read: How to Keep Track of Every Naira as a Nigerian SME

Why Profit and Loss Matters for New Entrepreneurs in Nigeria

Understanding profit and loss helps you:

-

Know if your business model actually works

-

Control expenses before they get out of hand

-

Price your products correctly

-

Prepare for tax obligations

-

Speak confidently with investors or lenders

Without a clear P&L, growth becomes guesswork.

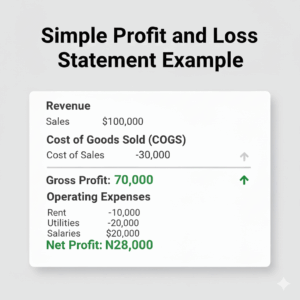

Components of a Profit and Loss Statement

Revenue

This is all the money your business earns from sales or services before expenses.

Examples in Nigeria include:

Suggested read: Valuation 101: How Clean Books Increase Your Company’s Worth

-

Sales of goods

-

Service fees

-

Commissions

Cost of Goods Sold (COGS)

These are direct costs tied to what you sell.

Examples:

-

Inventory purchases

-

Raw materials

-

Direct labor

Gross Profit

Gross profit is revenue minus cost of goods sold.

This tells you if your core business activity is profitable.

Suggested read: Scenario Planning: “What If Sales Drop 20%?” Modeling Best & Worst Cases

Operating Expenses

These are everyday business costs not directly tied to production.

Examples:

-

Rent

-

Data and internet

-

Salaries

-

Transportation

-

Marketing

Net Profit or Loss

This is what remains after all expenses.

If the number is positive, you made a profit. If negative, you ran at a loss.

How to Calculate Profit and Loss Step by Step

For new entrepreneurs, simplicity matters.

Suggested read: Profit Margins: Identifying Which Product Line Is Actually Making Money

Step 1: Add up all revenue for the period

Step 2: Subtract cost of goods sold

Step 3: Subtract operating expenses

Step 4: The result is your net profit or loss

Simple formula:

Revenue – Expenses = Profit or Loss

This basic structure applies to every Nigerian business, whether you run a fashion brand, tech startup, or food business.

Common Profit and Loss Mistakes New Entrepreneurs Make in Nigeria

Mixing Personal and Business Money

This is the most common mistake. Once personal spending enters business accounts, your P&L becomes unreliable.

Ignoring Small Expenses

Transport, bank charges, and subscriptions add up. Ignoring them inflates profit on paper but not in reality.

Not Tracking Regularly

Waiting until the end of the year is too late. Problems grow quietly.

Confusing Cash Flow With Profit

Having money in your account does not mean you are profitable.

Understanding profit and loss for new entrepreneurs in Nigeria means avoiding these traps early.

How Often Should You Review Your Profit and Loss?

For small and growing businesses, monthly reviews work best.

Monthly P&L reviews help you:

Suggested read: Business vs Personal Money: Why Every Entrepreneur Should Separate Their Accounts

-

Spot rising costs early

-

Adjust pricing

-

Plan inventory

-

Make smarter decisions

Quarterly and yearly reviews are important, but monthly visibility keeps you in control.

Using Profit and Loss to Grow Your Business

Profit and loss is not just a report. It is a decision tool.

With a clear P&L, you can:

-

Identify your most profitable products

-

Cut unnecessary expenses

-

Decide when to hire

-

Know when to expand

Smart entrepreneurs use profit and loss as a guide, not as paperwork.

Suggested read: How to Create a Financial Model That Attracts Venture Capital: Essential Playbook

This is where tools like AI-powered financial assistants become valuable, especially for founders without accounting backgrounds.

FAQs

What is a profit and loss statement in Nigeria?

A profit and loss statement in Nigeria shows a business’s income, expenses, and net profit over a period. It helps entrepreneurs understand financial performance and make informed decisions.

Do small businesses in Nigeria need profit and loss statements?

Yes. Even small businesses need profit and loss statements to track performance, manage expenses, and prepare for taxes or funding opportunities.

How can I prepare profit and loss without an accountant?

You can prepare basic profit and loss using spreadsheets or accounting software. Many Nigerian entrepreneurs now use automated tools that generate P&L reports instantly.

Is profit and loss required for tax purposes in Nigeria?

Yes. Profit and loss statements help calculate taxable income and support compliance with Nigerian tax authorities.

What is the difference between profit and cash flow?

Profit shows earnings after expenses. Cash flow shows money movement. A business can have cash but still be unprofitable.

Conclusion

Understanding profit and loss for new entrepreneurs in Nigeria is one of the smartest skills you can develop as a business owner. It brings clarity, control, and confidence to your decisions.

Profit does not happen by accident. It is measured, managed, and improved.

Suggested read: The Importance of Financial Transparency in Startup Growth

If you want an easier way to track profit, expenses, and financial performance without stress, tools like Zaccheus are designed to help Nigerian entrepreneurs stay profitable and financially confident.

Call to Action

Ready to take control of your business finances?

Explore how Zaccheus, for startups and small businesses, helps entrepreneurs track profit and loss automatically and make smarter financial decisions.

Visit usezaccheus.com to get started.