How to Use Simple Spreadsheets or Zaccheus to Track Business Income and Expenses

When Aisha started her baking business in Lagos, she wrote down sales in a notebook and trusted her memory for …

When Aisha started her baking business in Lagos, she wrote down sales in a notebook and trusted her memory for expenses. Two months later, she could not tell if she was making profit or just staying busy.

This is the reality for many entrepreneurs. Without a system to track business income and expenses, money slips through unnoticed.

The good news is you do not need to be an accountant. In this guide, you will learn how to use simple spreadsheets or Zaccheus to track your finances clearly, avoid mistakes, and make smarter business decisions.

Why Tracking Business Income and Expenses Matters

Tracking income and expenses is the foundation of financial control.

When you consistently track business income and expenses, you can:

-

Know if your business is profitable

-

Control unnecessary spending

-

Prepare for taxes

-

Make confident growth decisions

Without tracking, you are running your business on assumptions instead of facts.

Suggested read: Starter’s Guide to Profit and Loss for New Entrepreneurs in Nigeria

Using Simple Spreadsheets to Track Business Income and Expenses

Spreadsheets are often the first step for new entrepreneurs because they are accessible and affordable.

You can use:

-

Microsoft Excel

-

Google Sheets

A basic spreadsheet helps you record:

-

Date

-

Description

-

Income received

-

Expense paid

-

Payment method

This method works well for very small businesses with low transaction volume.

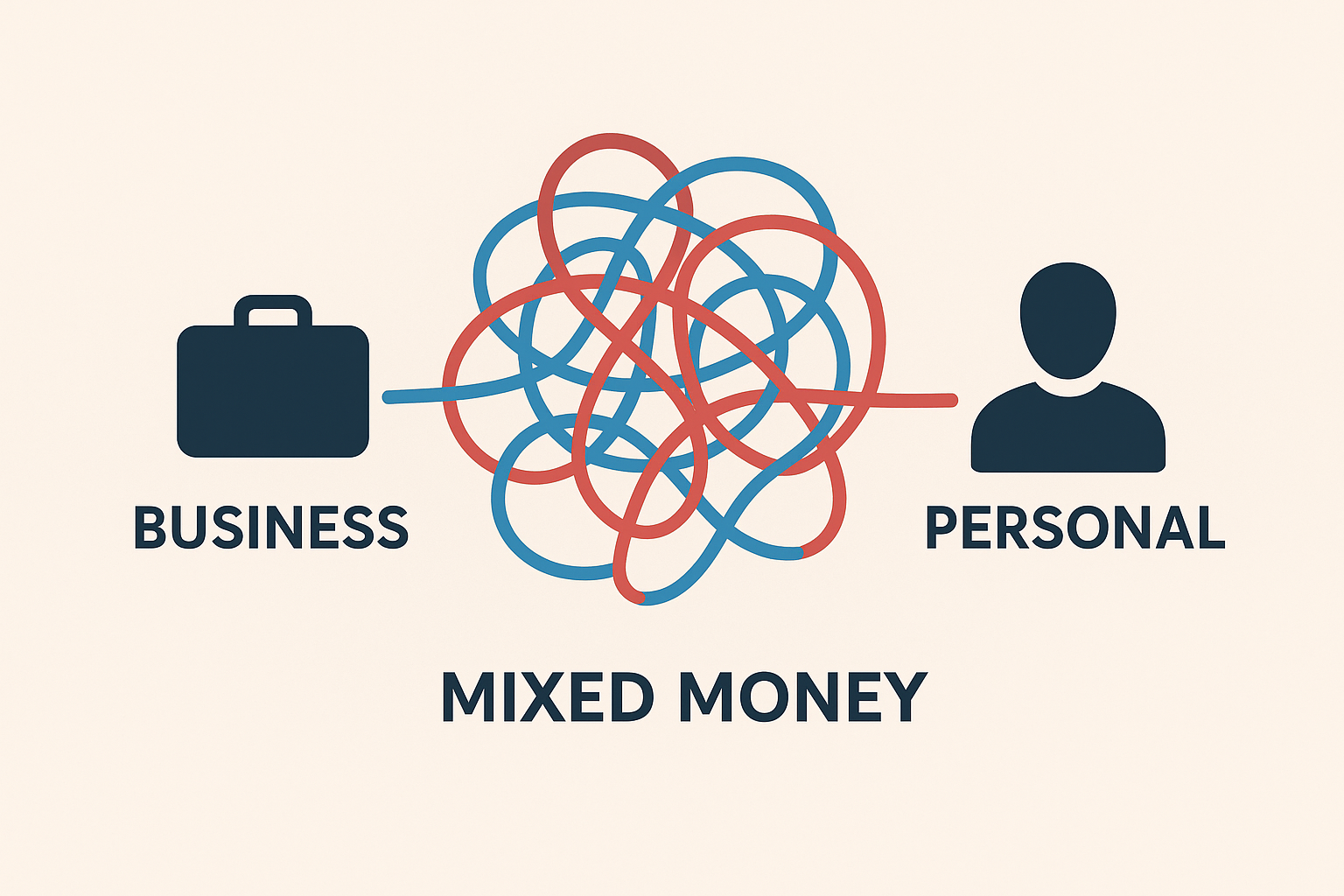

Suggested read: Business vs Personal Money: Why Every Entrepreneur Should Separate Their Accounts

Spreadsheet Setup Step by Step

To track business income and expenses using spreadsheets:

-

Create separate sheets for income and expenses

-

Add columns for date, description, amount, and category

-

Update entries daily or weekly

-

Review totals at the end of each month

Consistency matters more than complexity. A simple sheet used regularly beats a complex one ignored.

Limitations of Manual Spreadsheets

While spreadsheets are helpful, they come with challenges.

Suggested read: How to Keep Track of Every Naira as a Nigerian SME

Common limitations include:

-

Human error from manual entry

-

Time-consuming updates

-

No automatic insights or reports

-

Difficult scaling as business grows

As transactions increase, spreadsheets can quickly become overwhelming.

![]()

![]()

How Zaccheus Simplifies Tracking Business Income and Expenses

Zaccheus is built for entrepreneurs who want clarity without complexity.

With Zaccheus, you can:

-

Automatically track income and expenses

-

Categorize transactions accurately

-

Generate profit and loss reports instantly

-

See real-time financial insights

Instead of spending hours updating spreadsheets, Zaccheus works quietly in the background.

Suggested read: Understanding the Link Between Accounting and Business Growth

Spreadsheet vs Zaccheus: Which Is Better?

| Feature | Spreadsheets | Zaccheus |

|---|---|---|

| Ease of setup | Moderate | Easy |

| Automation | None | Full |

| Error risk | High | Low |

| Financial insights | Manual | Automatic |

| Scalability | Limited | High |

Spreadsheets are good for starting. Zaccheus is better for growing.

Choosing the Right Option for Your Business

If you are just starting out with few transactions, spreadsheets may be enough.

If your business is growing, expenses are increasing, or you want clearer financial decisions, Zaccheus offers a smarter way to track business income and expenses without stress.

The right tool depends on your growth stage, not your business size.

FAQs:

What is the best way to track business income and expenses?

The best way depends on business size. Small businesses can start with spreadsheets, while growing businesses benefit from automated tools like Zaccheus.

Suggested read: Small Company Tax Exemption: Is Your Business Really Tax-Free at ₦25m or ₦50m?

Can I use Excel to track business income and expenses?

Yes. Excel and Google Sheets can be used to record income and expenses manually, though they require consistent updates.

Why should entrepreneurs track expenses regularly?

Regular tracking prevents overspending, improves profitability, and helps entrepreneurs make informed decisions.

Is Zaccheus better than spreadsheets?

Zaccheus offers automation, accuracy, and insights that spreadsheets cannot provide, especially as businesses grow.

How often should I update income and expense records?

Weekly updates are ideal. Daily updates are even better for accuracy and control.

Conclusion

Learning how to track business income and expenses is one of the smartest habits an entrepreneur can build. Whether you start with simple spreadsheets or move to Zaccheus, consistency is key.

As your business grows, automation becomes less of a luxury and more of a necessity.

Call to Action

If you are tired of manual spreadsheets and want clearer financial insights, Zaccheus helps you track income and expenses automatically and make smarter business decisions.

Visit usezaccheus.com to get started to