Business vs Personal Money: Why Every Entrepreneur Should Separate Their Accounts

When Tunde launched his small skincare brand from his living room, he used one bank account for everything like transport, …

When Tunde launched his small skincare brand from his living room, he used one bank account for everything like transport, groceries, shea butter supplies, even Netflix. It felt simple at first. But three months later, he couldn’t tell which expenses belonged to him and which belonged to the business.

When tax season arrived, his accountant asked for records. Tunde froze. He had none.

A single mistake, mixing funds turned his promising business into a confusing, stressful mess.

Many entrepreneurs start just like Tunde. But the moment your personal and business money collide, problems begin quietly…and grow fast.

Why Separating Business vs Personal Money Matters

Entrepreneurs often start small and use one account for everything. It feels convenient at first, but over time, the smallest purchases pile up and become impossible to sort.

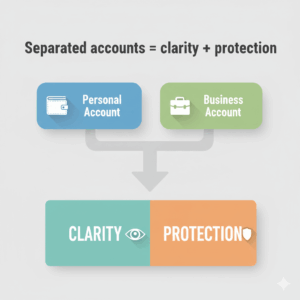

Clear separation gives structure that protects you legally and financially.

Top Risks of Mixing Personal and Business Money

1. Messy Taxes and Incorrect Deductions

When personal and business expenses live in one account, tax filing becomes confusing. You risk over-reporting or under-reporting expenses.

2. Legal Liability Problems

If you operate an LLC or corporation, mixing funds can “pierce the corporate veil.” Courts may rule that your business isn’t separate from you.

3. Inaccurate Cash Flow Tracking

You cannot make smart business decisions if revenue and expenses are buried inside personal transactions.

4. No Professional Image

Vendors, clients, and banks trust companies that run clean financial systems.

Benefits of Keeping Business and Personal Finances Separate

1. Clearer Financial Reporting

Instant visibility into profit, revenue, and burn rate.

2. Stronger Legal Protection

Clean separation protects your personal assets.

3. Easier Tax Filing

Tracking deductions becomes straightforward.

Suggested read: The “Agency” Dilemma: Managing Project-Based Finances vs. Recurring Revenue

4. Better Access to Funding

Investors, banks, and grant programs require clear records.

How to Separate Your Business vs Personal Money Properly

1. Open a Business Bank Account

Choose one with low fees and digital tools.

2. Pay Yourself a Salary or Owner Draw

Create a predictable transfer schedule instead of random withdrawals.

3. Get a Business Debit or Credit Card

Ensures all business spending is traceable.

4. Store Receipts in One Digital System

Use cloud tools to keep proof of business purchases.

5. Build a Clear Budget

Separate budgets keep your personal lifestyle and company needs independent.

Tools and Systems That Keep Your Money Organized

Great tools include:

-

Accounting software

-

Expense categorization tools

-

Invoicing platforms

-

AI financial tools like Zaccheus, an AI CFO

Why Zaccheus Helps:

Zaccheus analyzes cash flow, tracks expenses automatically, and simplifies reporting. This creates clean separation between personal and business transactions.

Suggested read: Business vs. Pleasure: The Danger of Commingling Funds

FAQs

1. Why is it important to separate business and personal money?

It protects you legally, improves tax accuracy, and gives you financial clarity. Without separation, errors appear easily and your company looks less professional.

2. Can I use my personal bank account for business?

You can in the very early stages, but it creates confusion and liability risks. A business account is always better.

3. What happens if I mix personal and business money?

You may lose legal protection for your LLC or corporation. Bookkeeping becomes harder, and tax deductions may be rejected.

4. How do I pay myself?

Use a consistent method. LLCs and sole proprietors use draws; corporations use salaries.

5. Does separating accounts help with funding?

Yes. Investors and lenders require clean, structured financial records.

Conclusion + CTA

Separating your business and personal finances isn’t just a good habit, it is a foundation for growth, legal protection, and professionalism.

Start today: open your business account, choose your financial tools, and build clean systems that support your success.

Ready to organize your finances?

Try Zaccheus to automate tracking, reporting, and cash flow clarity.