How to Organize Business Finances as a Freelancer (Simple Guide)

Freelancers often juggle client work, deadlines, and income that swings up and down. Managing finances can feel overwhelming, especially when …

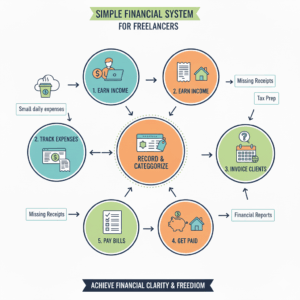

Freelancers often juggle client work, deadlines, and income that swings up and down. Managing finances can feel overwhelming, especially when invoices, receipts, and spreadsheets stack up in different corners of your life. This guide explains how to organize business finances as a freelancer in a clean, simple, and repeatable way. You will learn how to track expenses, create a reliable system, and turn scattered receipts into clear financial reports that help you grow.

Why Organizing Business Finances for Freelancers Matters

Most freelancers do not struggle because they lack talent. They struggle because their money management becomes chaotic. Organized business finances help you:

-

Understand exactly how much you earn

-

Track where your money goes

-

Avoid tax season stress

-

Make smarter pricing decisions

-

Plan for slower months

A simple financial system gives you calm, clarity, and control.

How to Start Organizing Business Finances for Freelancers With a Simple System

1. Separate Business and Personal Money

A dedicated business bank account keeps your finances clean. It prevents confusion and makes taxes easier. Your income, expenses, subscriptions, and payouts stay in one place.

2. Use Categories You Can Stick With

Aim for clear and broad categories such as:

Suggested read: Valuation 101: How Clean Books Increase Your Company’s Worth

-

Marketing

-

Software

-

Education

-

Travel

-

Client projects

-

Admin expenses

Your goal is consistency, not perfection.

3. Set a Weekly Money Routine

Pick one day each week to review your numbers. Ten minutes is often enough. During this time:

-

Upload new receipts

-

Log expenses

-

Check incoming payments

-

Track late invoices

This habit prevents headaches later.

Suggested read: How Much Cash Runway Does a Nigerian SME Actually Need?

How to Handle Receipts and Expenses

Freelancers drown in receipts because they wait too long to deal with them. Instead, create a simple workflow.

1. Go Digital Immediately

Snap photos of receipts as soon as you get them. Store them in a single folder or app. Never keep crumpled paper lying around.

2. Use Consistent Labeling

Name each receipt with the format:

Date – Vendor – Category – Amount

Example: 2025-02-10 Canva Marketing 12.99

3. Automate What You Can

Tools like Zaccheus automatically categorize transactions and sync them into reports, saving you hours of manual work.

How to Track Income the Easy Way

Income tracking lets you understand your business health.

1. Record Payments by Project

This helps you see which work delivers the highest return. Include:

-

Client name

-

Project type

-

Payment date

-

Amount

2. Track Outstanding Invoices

A simple table prevents you from forgetting unpaid work.

Suggested read: What to Do When Clients Pay Late: Cash Flow Strategies for SMEs and Freelancers

3. Use Templates for Speed

Keep invoice templates ready so you can send them right after delivering work. Fast invoicing leads to faster payments.

Create Monthly and Quarterly Reports

Reports help freelancers make informed decisions instead of guessing.

Monthly Reports Should Include:

-

Total income

-

Total expenses

-

Profit for the month

-

Top spending category

-

Biggest clients

-

Notes about what worked

Quarterly Reports Should Include:

-

Profit trends

-

High performing services

-

Potential tax liabilities

-

Cash flow patterns

Zaccheus generates these reports instantly so you do not need to build spreadsheets from scratch.

Suggested read: How to Identify Profit Leaks in Your Business

The Tools You Need for Stress-Free Management

These tools simplify your freelancer finance system:

1. Accounting Software

Choose lightweight tools built for freelancers

2. Receipt Scanning Tools

Apps that capture and store receipts help you stay organized.

Suggested read: Understanding the Impact of Inflation on Business Valuation

3. Financial Automation

Zaccheus acts like your personal AI CFO. It handles transactions, categorizes expenses, sends insights, and prepares reports.

Common Mistakes Freelancers Make

-

Mixing personal and business money

-

Forgetting to save for taxes

-

Keeping receipts scattered

-

Ignoring overdue invoices

-

Tracking numbers only once a year

Avoid these pitfalls and your finances become easier to manage.

Conclusion

Organizing business finances as a freelancer does not need to be complicated. A simple system lets you stay on top of expenses, track income accurately, and turn receipts into reliable reports. When you organize your finances consistently, you build a stable foundation for long-term growth, confidence, and freedom.

Call to Action

Ready to make this even easier?

Try Zaccheus, your AI CFO, and get instant reports, clean categorizations, and automated financial clarity.

Visit usezaccheus.com to get started.

FAQs

1. What is the easiest way for freelancers to organize finances?

The easiest way is to separate business and personal accounts, track expenses weekly, store receipts digitally, and use simple software to generate reports. A small routine makes the entire system manageable and prevents year-end stress.

Suggested read: The “Agency” Dilemma: Managing Project-Based Finances vs. Recurring Revenue

2. Do freelancers really need bookkeeping tools?

Bookkeeping tools save countless hours. They categorize expenses, sync payments, and produce reports automatically. Freelancers often waste time manually sorting numbers, so smart tools help them stay focused on client work.

3. How do I prepare for tax season as a freelancer?

Keep receipts organized, track your income monthly, categorize expenses consistently, and store everything in one place. Having clean records ensures smooth filing and helps you avoid mistakes or missing deductions.

4. How often should freelancers review their finances?

A weekly ten-minute check is ideal. It helps you track new payments, add receipts, update invoices, and monitor cash flow. Regular reviews prevent surprises and keep your business stable.

5. What should freelancers track every month?

Track revenue, expenses, project profitability, overdue invoices, cash flow changes, and spending patterns. Monthly reports help you understand what drives growth and how to adjust your strategy.