The “Japa” Tax Implication: Managing Taxes When Your Co-Founder Leaves Nigeria

Most founders are unsure about managing taxes when a co-founder leaves Nigeria or “japas.” Mistakes in this process can create …

Most founders are unsure about managing taxes when a co-founder leaves Nigeria or “japas.” Mistakes in this process can create unexpected liabilities.

That assumption quietly creates financial risk.

Because FIRS still considers ownership changes and cross-border tax responsibilities, and failing to handle them correctly can:

- Trigger audits

- Generate unexpected tax liabilities

- Create disputes over company ownership and revenue

The critical question every startup founder must ask is:

How do you manage taxes when a co-founder leaves Nigeria, and what are the financial risks if you don’t?

Getting this right protects your company and ensures compliance, even when key stakeholders move abroad.

Why This Situation Creates Confusion

Many startups face uncertainty because:

- “Japa” is often sudden, with minimal legal or tax planning

- Ownership changes aren’t always properly documented

- FIRS tax obligations can differ depending on whether the co-founder remains a shareholder, receives dividends, or continues to earn income from the company

Result: Founders risk both personal and corporate tax exposure if this is ignored.

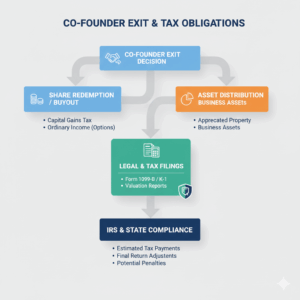

Key Considerations for Managing Taxes When a Co-Founder Leaves

- Personal Income Tax (PAYE or CIT)

If the departing co-founder continues receiving dividends, profit shares, or salaries, Nigerian tax law still applies. - Capital Gains Tax

Transferring shares to another co-founder or selling to a new investor triggers capital gains considerations. - Withholding Obligations

The company may need to withhold taxes on any payments made to the co-founder abroad. - Company Records and Compliance

FIRS may require updated shareholder records and filings reflecting the co-founder’s exit.

A Short Story Most Founders Recognize

Tunde and Aisha co-founded a tech startup. Aisha “japad” to the UK but retained 30% ownership.

Suggested read: Withholding Tax (WHT) Simplified: How to Stop Losing 10% on Every Invoice

Months later, FIRS requested updated records and proof of taxes paid on dividends she still received.

Because Tunde hadn’t updated the company’s filings or set up withholding mechanisms, penalties and interest accrued.

Lesson: co-founder exits require both legal and tax foresight.

Steps for Managing Taxes After a Co-Founder “Japas”

- Update Shareholder Agreements – Document the exit clearly, including profit and dividend rights.

- Notify FIRS and CAC – Ensure both tax authorities and company records reflect the change.

- Withhold Taxes When Required – Use Nigerian withholding rules for payments abroad.

- Track Dividends and Profit Shares – Keep accurate accounting to support tax filings.

- Use Financial Intelligence Tools – Platforms like Zaccheus track ownership changes, revenue allocations, and potential tax obligations automatically.

Why This Matters for Startups

- Protects founders from unexpected personal liability

- Avoids corporate penalties for non-compliance

- Maintains trust with investors and co-founders abroad

Proper tax planning is not optional when founders or key stakeholders move internationally.

How Zaccheus Solves This Problem

Zaccheus helps businesses:

- Track departing co-founder ownership and revenue rights

- Flag withholding obligations automatically

- Prepare compliant tax filings reflecting changes in shareholding

- Ensure cross-border revenue is properly accounted for

Your CFO shouldn’t just record exits, it should prevent tax surprises before they happen.

Conclusion: Japa Is Not Tax-Free

The “Japa” tax implication proves one thing clearly: moving abroad doesn’t remove obligations.

To avoid penalties, audits, or lost revenue:

- Update ownership and shareholder records

- Track payments to departing co-founders

- Ensure FIRS compliance at every step

Call to Action

A co-founder is leaving Nigeria, and you’re unsure about tax obligations?

Let Zaccheus, your AI CFO, track ownership changes, dividends, and tax obligations to keep your company compliant.

Suggested read: Digital Business Tax in Nigeria: Does Your Online Course Owe ₦25M+ in Taxes?

Manage Japa tax implications with Zaccheus today

FAQ Section

What are Japa tax implications?

They are tax obligations arising when a co-founder leaves Nigeria but retains ownership or profit rights.

Does a departing co-founder still pay Nigerian taxes?

Yes, on income or dividends sourced from Nigerian business activities.

Do companies need to withhold taxes for co-founders abroad?

Yes, Nigerian tax law may require withholding on cross-border payments.

How can startups avoid penalties when a co-founder leaves?

Update shareholder agreements, notify FIRS, track payments, and use financial intelligence platforms.

Can Zaccheus help with Japa tax planning?

Yes, Zaccheus tracks ownership changes, allocates revenue correctly, and ensures compliance automatically.