Personal Accounts for Business: Why Banks Are Flagging Them in 2025

Many small business owners still run their companies through personal accounts for business. In 2025, Nigerian banks are cracking down …

Many small business owners still run their companies through personal accounts for business.

In 2025, Nigerian banks are cracking down and the consequences can be costly.

From account freezes to flagged transactions, using a personal account for business activities is no longer a small risk.

The critical question every entrepreneur must ask is:

Why are banks flagging personal accounts for business in 2025, and how can you protect your company?

Getting this right protects your funds, prevents unnecessary scrutiny, and keeps your business running smoothly.

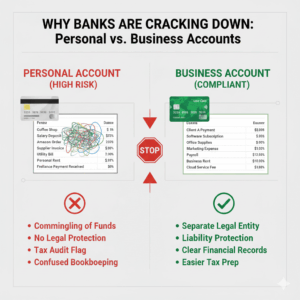

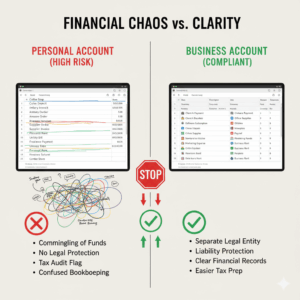

Why Banks Are Cracking Down in 2025

- Regulatory Pressure – The Central Bank of Nigeria (CBN) has tightened rules for business transactions in personal accounts.

- Anti-Money Laundering Compliance – Banks must monitor accounts to prevent illegal activities.

- Tax and Reporting Visibility – Personal accounts make it harder for authorities to trace taxable income.

- Technology Advancements – Banks now detect patterns of business activity in personal accounts more efficiently.

Result: Banks are flagging accounts that show regular business deposits, payments, or high transaction volumes.

Risks of Using Personal Accounts for Business

- Account Freezes or Holds – Banks can freeze accounts suspected of business activity.

- Transaction Flagging – Frequent deposits, transfers, or receipts can trigger alerts.

- Limited Access to Banking Services – Loans, credit facilities, and digital payment platforms may be restricted.

- FIRS Scrutiny – Personal accounts used for business make tax reconciliation harder.

Key takeaway: Using a personal account for business can slow growth and expose your business to risk.

A Short Story Most Entrepreneurs Recognize

Emeka ran a small logistics company through his personal account.

In 2025, his bank flagged his account after noticing frequent large deposits from clients. His account was temporarily frozen, causing delays in payroll and vendor payments.

Suggested read: The ₦100M Tax Threshold: What Nigerian Founders Must Know

Lesson: mixing personal and business finances can disrupt operations and invite compliance risks.

How To Stay Compliant in 2025/2026

- Open a Dedicated Business Account – Ensure all business transactions flow through a separate account.

- Maintain Accurate Records – Track income and expenses for bookkeeping and tax purposes.

- Educate Your Team – Ensure employees understand not to use personal accounts for payments or receipts.

- Leverage AI Financial Tools – Platforms like Zaccheus can track business transactions, categorize expenses, and detect compliance risks early.

Why This Matters for SMEs

- Protects your funds from freezes or flagged transactions

- Simplifies tax filing and financial reporting

- Increases credibility with banks and investors

- Ensures smooth day-to-day operations

How Zaccheus Helps

Zaccheus can:

- Track whether personal accounts are being used for business

- Flag risky transactions that may trigger bank scrutiny

- Provide actionable insights for separating personal and business finances

- Help maintain compliance and protect your banking privileges

Your CFO shouldn’t just track numbers, it should safeguard your accounts and prevent disruptions.

Conclusion: Separate Your Accounts, Protect Your Business

Using personal accounts for business in 2025 is a high-risk practice.

To avoid bank freezes, compliance issues, and unnecessary delays:

- Switch to a dedicated business account

- Track transactions diligently

- Use tools like Zaccheus to monitor and flag potential issues

Call to Action

Still running your business through a personal account?

Let Zaccheus, your AI CFO, track your transactions, separate personal and business finances, and help you stay compliant.

Protect your business finances with Zaccheus today

FAQ Section

Can I use a personal account for business in Nigeria?

Technically yes, but banks may flag it for compliance reasons, especially if transactions are frequent or high-value.

Suggested read: The 2025 Finance Act: 5 Clauses That Will Change How You Do Business

Why are banks cracking down on personal accounts for business in 2025?

Regulatory compliance, anti-money laundering, tax reporting, and transaction monitoring are driving stricter scrutiny.

What’s the risk of using personal accounts for business?

Freezes, flagged transactions, limited banking services, and tax reporting complications.

How can I prevent my personal account from being flagged?

Switch to a dedicated business account and maintain accurate records of all business transactions.

Can Zaccheus help monitor personal vs business accounts?

Yes, Zaccheus tracks transactions, flags risks, and ensures separation for compliance and reporting purposes.