FIRS & Auto-Populated Tax: How They Know Your Revenue Before You File

Most business owners believe tax filing is private, something handled only when forms are due. That assumption quietly costs millions …

Most business owners believe tax filing is private, something handled only when forms are due.

That assumption quietly costs millions every year.

Because today, FIRS can see your revenue before you even file.

Auto-populated tax notices are no longer a theory, they are a reality.

The critical question every founder must ask is:

How does FIRS know my revenue, and how can I avoid costly mistakes before filing?

Why FIRS Uses Auto-Populated Tax

The FIRS introduced auto-populated tax to:

- Reduce underreporting

- Improve accuracy in filings

- Make audits faster and more efficient

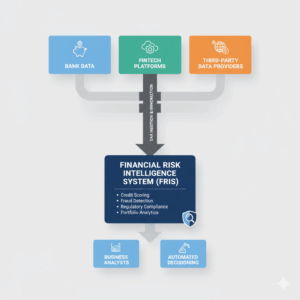

Previously, businesses self-reported revenue, often underestimating it. Today, banks, fintechs, and government agencies share transaction data, giving FIRS almost complete visibility of your income.

How FIRS Knows Your Revenue

- Bank Reports

Your business transactions through Nigerian banks are visible to FIRS. - Fintech & POS Data

Mobile payments, card readers, and online payments are automatically reported. - Third-Party Data

Certain service providers and government agencies provide transaction insights. - Past Tax Returns

Previous filings are compared to current revenue to flag discrepancies.

Result: FIRS rarely relies solely on your self-declaration. Auto-populated tax means your revenue is already known before filing.

The Risk of Ignoring Auto-Populated Tax

Mistakes in auto-populated returns can cost you:

Suggested read: Nigeria Tax Act 2025 Is Here: 5 Things Every Lagos Founder Must Do by Monday

- Incorrect filing → triggers audits

- Back taxes & interest → fines for underreporting

- Missed exemptions → overpayment of taxes

Assuming FIRS won’t notice is a costly risk.

A Short Story Most Founders Recognize

Chinwe runs a growing e-commerce business. One month, she received an auto-populated tax notice showing revenue higher than expected.

Her first reaction? Panic.

After reconciling her records with the notice, she corrected minor discrepancies and avoided penalties entirely.

Lesson: proactive monitoring prevents unnecessary fines.

How to Handle Auto-Populated Tax Correctly

- Reconcile Your Numbers – Match your bank and payment platform data to your accounting records.

- Verify Pre-Filled Values – Check every figure in the auto-populated return.

- Document Exceptions – Attach supporting documents for any differences.

- Use Financial Intelligence Tools – AI CFO platforms like Zaccheus track revenue, flag discrepancies, and keep filings accurate.

Why This Matters for Growing Businesses

As revenue increases:

- Auto-populated discrepancies become more visible

- Audits are more likely if data doesn’t match

- Compliance obligations expand

Visibility and accuracy are key to sustainable growth.

How Zaccheus Solves This Problem

Instead of guessing or manually checking:

- Tracks revenue from multiple sources automatically

- Flags mismatches with FIRS auto-populated data

- Prepares compliant reports for filing

- Provides clarity, reducing stress and avoiding penalties

Your CFO shouldn’t just file taxes. It should prevent mistakes before they happen.

Conclusion: Accuracy Beats Assumptions

Auto-populated tax proves one thing clearly: assumptions are costly.

Suggested read: Stamp Duty on Electronic Transfers in Nigeria: What Businesses Must Know

To avoid penalties, overpayment, and compliance risks, you must:

- Know your revenue in real time

- Verify auto-populated data

- Track assets and exemptions

Call to Action

Confused by auto-populated tax or unsure your revenue matches FIRS records?

Let Zaccheus, your AI CFO, reconcile your transactions and ensure your filings are accurate before penalties appear.

FAQ Section

Does FIRS automatically know all my revenue?

Yes, via banks, fintechs, and third-party reporting.

Can I correct auto-populated tax notices?

Yes. Reconcile your data and submit supporting documents.

Do auto-populated taxes increase penalties?

Not if you verify and submit accurate returns. Errors trigger penalties.

Which businesses are affected?

Any company using bank accounts or digital payments in Nigeria.

How can I prevent errors before filing?

An AI CFO platform like Zaccheus reconciles revenue and flags mismatches automatically.

Suggested read: Withholding Tax (WHT) Simplified: How to Stop Losing 10% on Every Invoice