Free Chart of Accounts Template Nigeria — Agencies, E-commerce & SaaS

If you run an agency, e-commerce store, or SaaS startup in Nigeria, you already know how messy bookkeeping can get. …

If you run an agency, e-commerce store, or SaaS startup in Nigeria, you already know how messy bookkeeping can get. Between multiple income streams, business expenses, and taxes, tracking your finances can feel like decoding hieroglyphics.

That’s where a Chart of Accounts (COA) comes in. It’s the foundation of your accounting system helping you categorize every transaction neatly and stay compliant with Nigerian tax regulations.

In this guide, we’ll show you how to structure your COA, what categories matter most for your business type, and provide a free COA template you can start using immediately.

What Is a Chart of Accounts?

A Chart of Accounts (COA) is a structured list of all the financial accounts used by your business. It serves as the blueprint for your accounting system, organizing transactions into categories like income, expenses, assets, liabilities, and equity.

In Nigeria, having a properly structured COA is essential for VAT filings, FIRS reporting, and financial audits.

Featured Snippet Answer :

A Chart of Accounts (COA) is a categorized list of all your business’s financial accounts. It helps organize income, expenses, assets, and liabilities, making it easier to track performance, prepare taxes, and produce accurate financial statements essential for Nigerian SMEs and startups.

Why Every Nigerian Business Needs a COA

A well-structured COA helps you:

-

Track income and expenses accurately

-

Stay compliant with FIRS tax laws

-

Generate cleaner reports for investors or grants

-

Simplify bookkeeping and reduce accountant errors

Without one, financial data becomes fragmented, and tax season turns chaotic.

Suggested read: The Hidden Drain: 5 Ways Nigerian SMEs Lose Cash Without Noticing

For startups and SMEs, especially those managing multiple revenue streams, your COA is your financial GPS without it, you’re driving blind.

Free Chart of Accounts Template (Nigeria)

To save you hours of setup time, we’ve built a free chart of accounts template tailored for Nigerian agencies, e-commerce brands, and SaaS startups.

This template includes every major account category your business needs, already formatted for Excel and Google Sheets.

Here’s what it looks like

Assets

| Account Code | Account Name | Description | Type |

|---|---|---|---|

| 1000 | Cash – GTBank | Main business account | Debit |

| 1100 | Accounts Receivable | Client payments pending | Debit |

| 1200 | Equipment | Laptops and tools | Debit |

| 1300 | Prepaid Expenses | Rent or subscriptions paid ahead | Debit |

Liabilities

| Account Code | Account Name | Description | Type |

|---|---|---|---|

| 2000 | Accounts Payable | Unpaid supplier invoices | Credit |

| 2100 | VAT Payable | VAT owed to FIRS | Credit |

| 2200 | Short-Term Loans | Credit lines or overdrafts | Credit |

Income

| Account Code | Account Name | Description | Type |

|---|---|---|---|

| 3000 | Service Revenue | Client retainers or contracts | Credit |

| 3100 | Product Sales | E-commerce or POS revenue | Credit |

| 3200 | Subscription Income | SaaS monthly plans | Credit |

Expenses

| Account Code | Account Name | Description | Type |

|---|---|---|---|

| 4000 | Rent | Office or warehouse rent | Debit |

| 4100 | Salaries | Staff wages | Debit |

| 4200 | Marketing & Ads | Campaign budgets | Debit |

| 4300 | Internet & Utilities | Data, electricity | Debit |

| 4400 | Software Subscriptions | SaaS tools | Debit |

Equity

| Account Code | Account Name | Description | Type |

|---|---|---|---|

| 5000 | Owner’s Capital | Funds invested | Credit |

| 5100 | Retained Earnings | Accumulated profits | Credit |

Chart of Accounts Examples by Industry

For Agencies

-

Revenue: Client Retainers, Service Fees

-

Expenses: Salaries, Subcontractor Payments, Advertising

-

Assets: Office Equipment, Accounts Receivable

For E-commerce Businesses

-

Revenue: Product Sales, Delivery Fees

-

Expenses: Packaging, Logistics, Payment Gateway Fees

-

Assets: Inventory, Online Store Software

For SaaS Startups

-

Revenue: Monthly Subscriptions, Setup Fees

-

Expenses: Server Costs, Marketing, Developer Salaries

-

Assets: Software Licenses, Prepaid Hosting

How to Customize Your COA for Nigeria’s Tax System

To align your COA with Nigerian compliance standards:

Suggested read: The Rise of the Zero-Employee Finance Department

-

Include VAT Payable and VAT Input accounts for 7.5% VAT tracking.

-

Separate Withholding Tax (WHT) from income to simplify filings.

-

Use clear naming (e.g., GTBank, ZenithBank, Flutterwave).

-

Regularly reconcile your COA with FIRS-approved reporting templates.

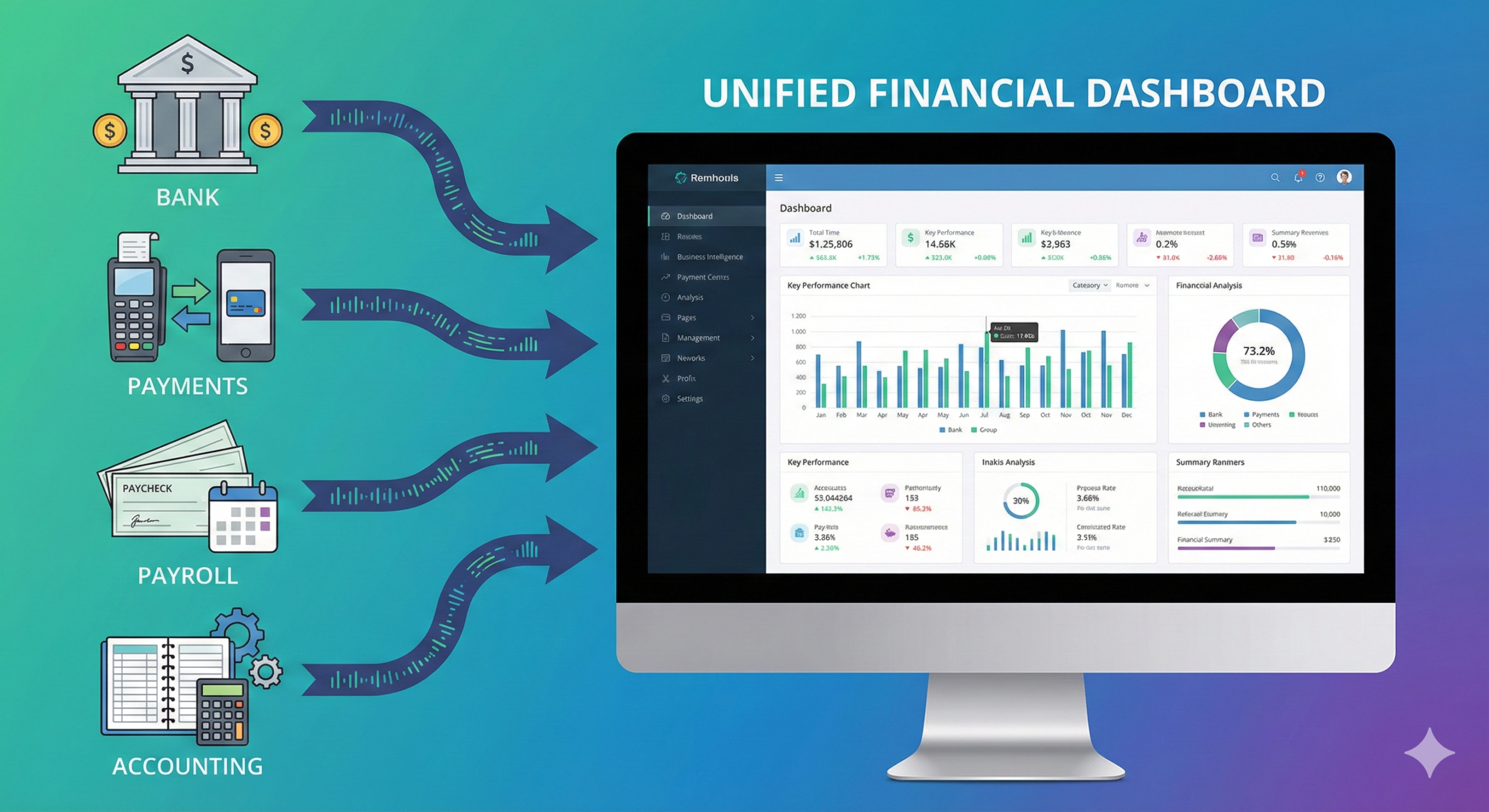

Automate Your COA Management with Zaccheus

Manual bookkeeping is outdated. Zaccheus, your AI CFO for Nigerian SMEs, can:

Suggested read: The Joint Revenue Board: How Your NIN, BVN, and Tax ID Are Now Linked

-

Automatically categorize transactions

-

Sync data from your bank or payment processor

-

Generate VAT and WHT reports instantly

-

Help you stay compliant without hiring an accountant

Zaccheus transforms your static COA into a living, automated financial dashboard.

Visit usezaccheus.com to see how it works.

FAQ

1. What is a Chart of Accounts template used for?

It helps Nigerian businesses organize income, expenses, assets, and liabilities in one system, making tax filings and financial reports easier.

2. Can I use the same COA for all my businesses?

You can start with one template, but it’s best to tailor account names to each business type for clarity.

3. What’s the standard VAT rate in Nigeria?

As of now, Nigeria’s VAT rate is 7.5%, applicable to most goods and services except exempt categories.

Suggested read: VAT Fiscalisation Explained: Why Your Business Needs Automated E-Invoicing Today

4. Do I need accounting software to use a COA?

No. You can use Excel or Google Sheets. However, automation tools like Zaccheus simplify and update your COA automatically.

5. How often should I update my COA?

Review it quarterly to add or remove accounts as your business grows or tax rules change.

Conclusion

Your Chart of Accounts (COA) is more than a spreadsheet. It’s the foundation of your financial clarity. With the chart of accounts template in Nigeria, you can organize every transaction, simplify tax filing, and understand your business performance at a glance.

Whether you run a marketing agency, online store, or SaaS startup, this template is your starting point for smarter accounting.

Simplify your finance management today with Zaccheus your AI CFO for Nigerian businesses.