VAT Fiscalisation Explained: Why Your Business Needs Automated E-Invoicing Today

It is 9:07 a.m. Your accountant messages you in a panic. Yesterday’s invoice was rejected by the tax authority. The …

It is 9:07 a.m. Your accountant messages you in a panic. Yesterday’s invoice was rejected by the tax authority. The reason? Non-compliance with VAT fiscalisation rules you did not even know had changed.

For many founders and SMEs, this moment is becoming more common. Governments are tightening VAT controls, rolling out real-time reporting, and enforcing fiscalisation frameworks that leave no room for manual errors.

This is exactly why automated e-invoicing is no longer optional. It is becoming a survival tool for modern businesses.

What Is VAT Fiscalisation?

VAT fiscalisation is a regulatory framework where tax authorities require businesses to issue invoices through approved systems that report transaction data in real time or near real time.

Instead of issuing a simple PDF or paper invoice, businesses must:

- Generate invoices using compliant formats

- Transmit invoice data to tax authorities

- Receive validation or fiscal codes

- Store invoices securely for audit purposes

Countries across Europe, Africa, and Latin America are rapidly adopting VAT fiscalisation to reduce tax fraud and improve transparency.

Why VAT Fiscalisation Is Accelerating Worldwide

Tax authorities are under pressure to close VAT gaps. According to EU data, billions are lost annually due to underreported VAT. Fiscalisation solves this by ensuring every taxable transaction is traceable.

For businesses, this shift means:

- Less flexibility with manual invoicing

- Stricter penalties for non-compliance

- More reporting obligations

Founders who treat VAT fiscalisation as “an accounting problem” often learn too late that it is actually an operational and cash-flow issue.

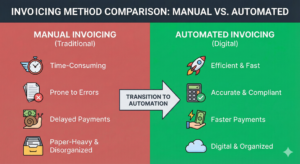

The Hidden Cost of Manual Invoicing

Manual invoicing systems were never designed for fiscalisation. They introduce risks that scale with your business.

Suggested read: Personal Income Tax vs Company Tax: Which Registration Is Better for You?

Common problems include:

- Invoices rejected due to formatting errors

- Delayed VAT filings and penalties

- Increased accounting workload

- Poor visibility into tax liabilities

For SMEs, these inefficiencies quietly drain time and money. For fast-growing startups, they slow down growth at the worst possible moment.

Why Automated E-Invoicing Is the Smart Move

Automated e-invoicing systems are built to meet VAT fiscalisation requirements by design.

With automated e-invoicing, your business can:

- Generate compliant invoices instantly

- Submit data to tax authorities automatically

- Reduce human error to near zero

- Maintain audit-ready records at all times

More importantly, automation removes fear. You stop worrying about whether your invoices will pass inspection because the system enforces compliance for you.

How Automated E-Invoicing Helps Founders and SMEs Scale

Founders should not spend their evenings reading VAT circulars. Automated e-invoicing frees mental bandwidth so you can focus on growth.

Key advantages include:

- Faster invoice approval and payments

- Real-time visibility into VAT exposure

- Easier expansion into new markets

- Lower reliance on manual accounting fixes

When paired with an AI CFO platform like Zaccheus, automated e-invoicing becomes part of a smarter financial stack rather than another compliance headache.

Getting Started Without Disrupting Your Business

Many SMEs delay automation because they fear disruption. The reality is that modern systems integrate seamlessly with existing workflows.

The right platform will:

Suggested read: The ₦100M Tax Threshold: What Nigerian Founders Must Know

- Sync with your sales and accounting tools

- Update automatically when regulations change

- Require minimal training for your team

The earlier you adopt, the smoother the transition will be as fiscalisation rules become stricter.

Frequently Asked Questions

What is the difference between VAT fiscalisation and e-invoicing?

VAT fiscalisation is the regulatory requirement imposed by tax authorities. E-invoicing is the technical method used to comply. Automated e-invoicing systems are designed to meet fiscalisation rules without manual intervention.

Is VAT fiscalisation mandatory for SMEs?

In many countries, yes or very soon. Governments typically roll out fiscalisation in phases, starting with large businesses and extending to SMEs. Waiting can lead to rushed and costly compliance later.

What happens if my invoices are not compliant?

Non-compliant invoices can be rejected, leading to delayed payments, penalties, audits, and reputational risk. In some jurisdictions, repeated non-compliance can result in business suspension.

Can automated e-invoicing reduce VAT errors?

Yes. Automation enforces correct formats, tax codes, and reporting rules, dramatically reducing human error and improving accuracy across all transactions.

Conclusion: Stay Ahead of VAT Fiscalisation

VAT fiscalisation is not a future problem. It is happening now, and it is reshaping how businesses invoice, report, and operate.

Automated e-invoicing gives founders and SMEs control, confidence, and compliance without complexity. Instead of reacting to regulation, you can stay ahead of it.

Ready to simplify VAT fiscalisation and take control of your finances?

Sign up for Zaccheus today and let your AI CFO handle e-invoicing, VAT compliance, and financial clarity so you can focus on growing your business.

Suggested read: Stamp Duty on Electronic Transfers in Nigeria: What Businesses Must Know